■ By Chris Cox, JD

Investing in new roll-forming equipment not only increases production capabilities, it may also lower your tax bill. The U.S. Tax Code provides a valuable incentive for manufacturers to invest in new production equipment. Specifically, Section 179(a) of the Tax Code allows businesses to deduct up to $1,040,000 of the purchase price of equipment that was (a)purchased and (b) placed into service in the applicable tax year.

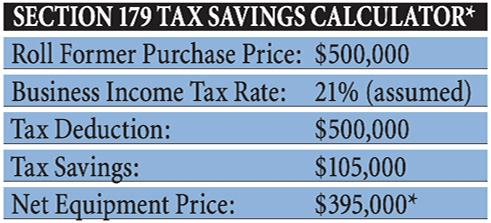

The following illustrative example shows just how valuable Section 179 deductions may be to a manufacturer that purchases equipment and places it into service in 2020:

Section 179 is a huge incentive for savvy business owners to upgrade their production capabilities at a significant discount. These purchases also stimulate economic development and employment for U.S.- and foreign-based equipment manufacturers, thereby generating tax revenue for the U.S. government.

The Section 179 deduction is also available for equipment that is leased or financed. Several equipment finance companies offer Section 179 qualified financing options. Businesses who purchase used equipment may also benefit from this tax incentive.

The $1,040,000 limit is tied to inflation and will likely increase in subsequent years. There are limits to the amount a business can deduct for equipment with a purchase price in excess of $2,500,000.

There are additional potential benefits and restrictions, and businesses should consult their tax professionals on Section 179 as it applies to their specific circumstances. Businesses should also contact equipment manufacturers to determine how quickly the new equipment can be delivered. The government provided the incentive—it’s up to manufacturers to take action to claim it.

Chris Cox, JD, is Southeast Sales Manager for ASC Machine Tools, Inc. He can be contacted at [email protected]

*This example is provided for illustrative purposes only and should not be considered as a guarantee, calculation, or projection of the actual deduction a business can claim and/or receive. Furthermore, nothing contained in this article shall be construed as legal advice or guidance. RF

Originally published as “Take Advantage of Tax Incentives for Equipment Purchases” Summer 2020 issue Rollforming Magazine.