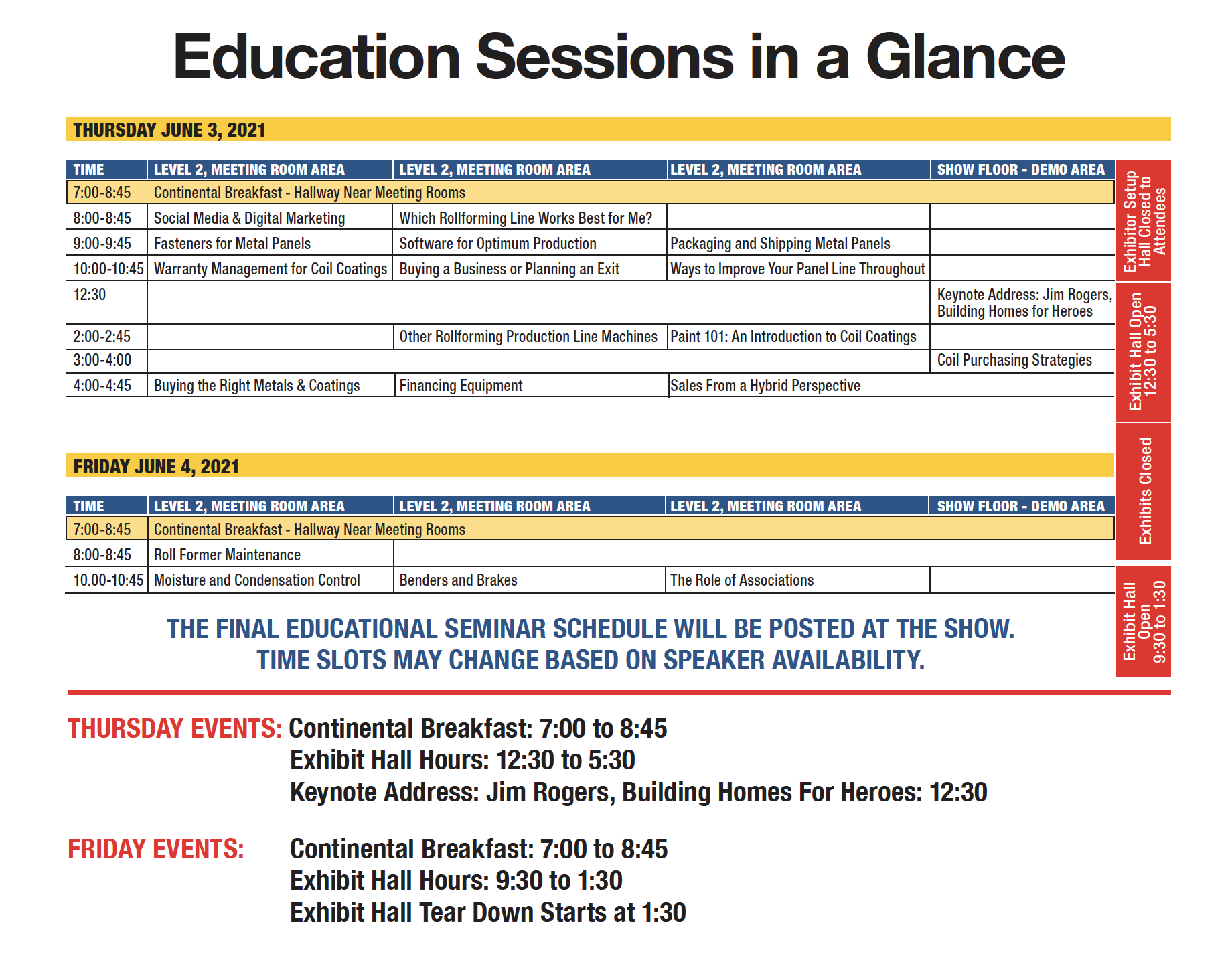

The METALCON 2024 annual conference and tradeshow was held from Wednesday, October 30 to Friday, November 1 at the Georgia World Congress Center in Atlanta. In addition to the hands-on workshops, networking and educational sessions, the event was an excellent opportunity to glean information about the metal construction industry, including opportunities and challenges, as well as insights into what the economy may look like in 2025.

The first morning of the show featured the State of the Industry Panel. The panel was comprised of industry experts that included Paul Trombitas, FMI Corp.; Brian Partyka, Carlisle Construction Materials; Bob Zabcik, Z-Tech Consulting; Tom Seitz, InSeitz & Strategies; Sean McCue, Precoat Metals; and Chandler Barden, CIDAN Machinery. The Metal Construction Association’s Jeff Henry served as the moderator.

Key Points of the State of the Metal Construction Industry

Keeping in mind there is no crystal ball, and situations could change quickly:

There was substantial growth from 2021-2023, and declining growth in 2024. A softening is expected in 2025-2026, with growth returning in 2027. The outlook is optimistic about the single-family residential space, while the multi-family decline is driven by overbuilding.

Non-residential and industrial is expected to see “unprecedented spending” over the next two to three years.

A continual bright spot is the re-roofing sector, which is reported to have the most backlog.

Additionally, the amount of metal being used in construction is up, and there’s growth in regional manufacturing of roofing and wall panels. The demand for custom wall panels is also on the rise. The development and availability of more diverse coatings and textures is having a positive impact on the industry in terms of growth. On the equipment side, there continues to be growth and expansion of automation to increase production and deal with labor variables.

Another quickly developing and changing facet of the industry is the coatings sector. Today’s technology has SMP and PVDF coatings lasting 35-40 years or longer, which is very attractive to end users (customers). Additionally, coating technology that uses electricity to cure coil coatings makes it more attractive because it imbues minimal carbon to the material, which has been an increasing concern for the last several years.

One of the challenges discussed was the difficulty in getting required building permits. Hurricanes and wildfires are contributing to changes in codes and standards, including material requirements. In the coming years, look for material labeling and testing requirements.

Dr. Anirban Basu delivers “…Financial

Outlook and Trends for Metal Construction” at METALCON

2024. Photo Courtesy of Neubek Photographers.

At right, The State of the Industry Panel included (L to R) Jeff Henry, (MCA); Paul Trombitas, FMI Corp.; Brian Partyka, Carlisle Construction Materials; Bob Zabcik, Z-Tech Consulting; Tom Seitz, InSeitz & Strategies; Sean McCue, Precoat Metals; and Chandler Barden, CIDAN Machinery. Shield Wall Media photo.

On the second day of the event, Dr. Anirban Basu, Chairman and CEO of Sage Policy Group, Inc., a Baltimore-based economic and policy consulting firm, delivered a presentation titled The Good, The Bad, & The Ugly: Financial Outlook and Trends for Metal Construction. Basu reflected on expectations for 2023, noting that a recession had seemed inevitable at the start of the year due to the challenges faced in 2022. However, this anticipated downturn didn’t happen. Instead, consumer spending surged, particularly on services like travel and concert tickets, leading to an increase in retail sales.

Basu highlighted that as of September 2024, there were 7.4 million job openings, including 288,000 in the construction sector, with consistent job growth each month since December 2020. While certain areas of the labor market have shown signs of weakening, construction wage premiums have declined relative to other industries. Personal savings, which had risen during the pandemic, have been depleted, and prices continue to rise.

He reported a 23% overall inflation rate, with energy, transportation services, and tobacco and smoking products experiencing the highest increases, while groceries were less affected. Additionally, credit card debt reached $1.14 trillion, the highest level since 2004. Basu warned that the current rate of consumer spending is unsustainable and predicted further economic slowing in the near future.

Key Points from Basu’s Presentation

The nation’s significant debt levels and high borrowing costs are cause for concern.

He expressed pessimism about the near-term economic outlook.

Geopolitical issues and upcoming federal elections contribute to economic uncertainty and risk.

While a slowdown is expected next year, a recession is no longer the baseline projection.

To catch the METALCON 2025 State of the Industry panel, mark your calendar: The event is slated for October 21-23, 2025, at the Las Vegas Convention Center. RF