■ By Sharon Thatcher

The pandemic brought big changes and concerns for more than just our health! High prices, limited supply of steel/aluminum coil expected through mid-2021.

Small- to medium-size roll-forming companies over the past few years had the luxury and convenience of knowing, without commitments or forecasting, their acrylic and prepainted coil needs. They could reach out to any number of coil distributors who were stocking all or most of their items.

That was until COVID-19 arrived in spring of last year, impacting multiple manufacturing segments using metal. With closures of auto assembly, appliance, aerospace plants and other industries due to COVID outbreaks and concerns, mills were being idled or closed short term over the unknown, and the fear of how long some of these manufacturers would be running at reduced productivity. About 20% of the U.S. metal industry output was taken off-stream as a result.

When businesses returned to normal productivity, consumption inventories of metal were shrinking because the mills held off bringing back most of the mills that were idled. Through 2019 and early 2020, capacity utilization had been running around 65%; most mills needed to be running at 70% or above to really make money.

Steve Swaney, Sales & Business Development at metal service center, Flack Global Metals, said the current situation is “re-writing the metal history books,” especially for the building products industry. It was enjoying a strong year particularly in the residential sector. Through the early months of COVID it was one of the least impacted due to the majority of the construction work done outside with natural social distancing among workers.

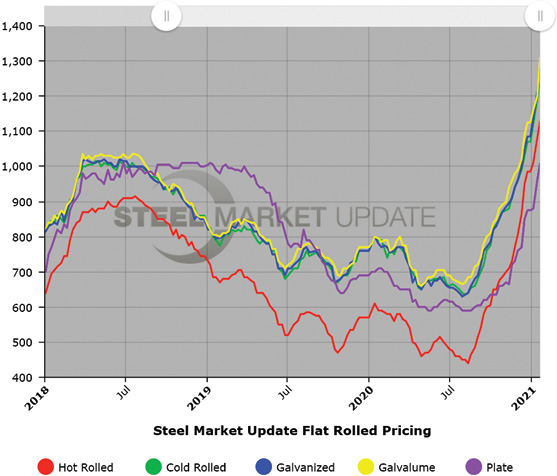

“We started 2020 with a buyer-driven market,” Swaney explained. “There was plenty of steel — metal pricing was near historic lows in some cases — then the market started on a meteoric rise starting in September, and within four months we saw the most rapid and dramatic price change and level surpassing the previous record year of 2008. We ended the year with hot-rolled steel more than doubling in price and galvanized and Galvalume not far from it.”

Due to the large amount of stock and inventory the major coil distributors had on hand, the erosion of inventory levels, and the series of price increases the mills were putting through disguised the impact in the roll-forming and fabrication sector. “It was not until October when people really started seeing and feeling the impact of rising cost and less available inventory,” Swaney explained. Still, due to the history of metal markets, there were those doubters who felt things would soon return to normal and continue on its trek.

“Once we got into mid- to late-November everyone was well aware the mills were in control and we had a runaway train on our hands,” Swaney continued. “COVID had allowed the mills to set up the ‘Perfect Storm’ for metal supply knowing service centers reduced their buying and inventory levels in fear over how COVID would impact [the market].

Within the storm clouds: 20% of the U.S. capacity had been taken off-line, NMLK had a union-strike, Section 232 tariffs and a weak dollar brought import levels to almost historic lows. “Yet,” Swaney said, “demand for metal remained strong and was actually increasing as we entered 2021.”

Bob Kula, Sales Manager—Building Products, for steel supplier Mill Steel, likens the recent steel market to a rocket ship ride. “We put our customers on allocation the middle of October because we could not get enough steel for our monthly demand, and a lot of our competitors were in a worse situation,” he said.

By the end of the year, excess inventory was nowhere to be found. “Typically, [steel coil] for buildings, there’s inventory on the ground all over the country, but that’s not the case anymore; it’s all dried up, therefore everything that comes in goes out at a very fast pace,” Kula said.

He has worked in various segments of the steel market for 30 years and hasn’t seen anything quite like it. “It is comparable to markets of 2004 and 2008, but the difference back then, in those markets, is that you could still get steel; it was just that the price was rising weekly. Now you can’t get steel, but you’re still paying the price.”

Graber Post Buildings, based in Indiana, has a diversified building supply business focused on post frame. It is a smaller, more regionalized steel supplier, with only about 7-8% of its business focused on direct coil sales to typically smaller rollformers. Graber also does its own roll forming for roof and wall panels that are sold retail, and used by their 30 subcontracted building teams.

Their coil sales business was caught in the price-and-supply dilemma starting when they ordered coil in September for October delivery. “We were told [by our supplier] that they just over-booked and they had to start limiting orders so they could catch back up,” steel purchasing agent Cole Wolford said. “I’m afraid it’s still going up. It went up pretty heavy for February deliveries and I think they’ll probably go up for March deliveries.” He said their coil division paid 33% more for steel from the lowest price in 2020 to the highest.

Wolford also said that some supplies have been easier to get than others, with no particular rhyme or reason. “We’ve got some stock taking 90 days that would normally take three or four weeks, six weeks if running late in a normal year,” he said. They have limited the amount of steel they offer coil customers to make sure they have enough for their own sub crews, and to satisfy the demands of their more regular roll-forming customers.

Important to note is that steel mills often have a multi-market focus, meaning they produce steel for HVAC, appliances, aerospace, transportation and other industries in addition to building products. As the mills gear back up, they need to service all those various interests.

Large distributors for that steel—service centers like Mill Steel and Flack Global—also serve multiple industries. Both companies saw the emergence of shortages for hot-rolled building products in particular.

When will relief come?

The prognosticators vary predictions from early second quarter to late third quarter before relief is seen for the price of steel to level off and supplies to ease up. COVID is still very much in control.

Good news so far is that the end user—the consumer—doesn’t seem to be bothered yet by the price increase and, in some areas of the country, are not yet impacted by significant delays. Typical winter slowdowns in northern areas have helped de-escalate concerns, along with the continuation of low interest rates, and a backlog of contracts lined up well into 2021. “Interest rates are so low that the difference in the interest rate is making up for steel pricing,” Cole Wolford said.

Steve Swaney believes light gauge building products will be first to recover from the low supply. “The construction sector, we think, will be one of the first markets that kind of balances itself out. The automotive and the appliance sectors, I think those guys are going to be struggling through mid-year to get caught up,” he noted.

What is a rollformer to do?

Bob Kula jokingly advises: “be very kind to your steel suppliers” but it is a message that bears consideration. Bottom line, loyalty pays off. When a business has a limited supply of product to sell, they tend to dole it out to the people who have been there with them for the long haul.

“Some of the guys trying to buy from us now, if they had been buying from us throughout the year, we would have had that [calculated] in our stocking program,” Cole Wolford said. “Loyal customers who buy from us all year, we want to make sure they get what they need.”

While Graber Post would like to accommodate all buyers, they now have to make tough choices, “because it’s just too hard on our own stock,” Wolford explained.

Steve Swaney sees a similar situation at Flack Global where they satisfy the demands of steel users in more than 30 states and across multiple platforms. He said recently, “we have been approached by customers that we’ve pursued for a year or two and our sales pitches have fallen on deaf ears. Now all of a sudden, in the last few months, we’ve become their best friends. Because we’re having to divvy up our inventory so selectively and support the people that have been there to support us; unfortunately, we’ve had to say ‘thanks but no thanks.’”

Turning business away is not what a supplier wants to do. “As a salesperson you want to sell steel and sell as much as you can,” Bob Kula said. “Now we’re having to say no. We’ve been saying no for four or five months, and it’s getting old.”

Aside from loyalty, limiting the diversity of what you offer is advisable until supply loosens up. “Most rollformers are used to offering up to 14 or 16 different colors,” Kula said. “My advice to a lot of them is reduce the number of colors you’re offering.” He suggests that rollformers carry about half their regular supply of colors, concentrating on their most popular and “if a customer has a color outside of those, then it’s considered a special order and they’re going to have to wait.”

Even then, common colors are hard for suppliers to keep in stock due to high demand. Colors like Polar White, Light Stone and Ash Gray have been delayed because coil coaters have also been caught in the middle of the coil shortage problem; they can’t coat what they don’t have.

Stocking less makes sense for small rollformers because the price will eventually come down, as it always does.

“The hedging is over,” Kula said. “I say just buy what you need. I wouldn’t buy long—by that I mean I wouldn’t buy extra inventory—because prices are so high right now and eventually prices will slide back.”

What the future looks like

Steve Swaney said rollformers are scrambling and many will need to change their business planning to avoid getting caught in situation similar to this in the future. Hedging, making some commitments, and working with coil suppliers with custom-managed inventory programs are the best ways for them to ensure availability, remove price volatility, and reduce risk. “I think all businesses will come out of this pandemic with some different strategies and plans,” he said. “I think for the first half of 2021 rollformers are going to have to plan on carrying more inventory and looking farther out than they have in the past. We are months away from having just-in-time inventory ready to go for them. Working with your suppliers in ordering, and forecasting a few months out is going to enable them to insure they can service and support their customers.”

He continued to emphasize that “there really is nothing throughout history to look back on where we are today. There’s too many different unique variables impacting the metal situation, and the economy in general, than any period prior that compares with what we’re encountering right now.”

If President Biden enacts his “Buy American Policy” for government purchasing items, Swaney believes it will help the domestic steel industry but also stimulate the need for markets like construction to supplement its needs with import. A strengthening dollar and higher Chinese steel output will help balance the world metal market supply-and-demand situation.

Buying steel offshore may become more appealing again despite higher tariffs on steel and long delivery delays. Prices for offshore steel are traditionally lower, but COVID also diminished worldwide steel supplies and China, whose economy was among the first to ramp up, has been on a buying spree to scarf up that supply.

If there is any comfort to be found, find it in the fact that you’re not alone. As Bob Kula tells his salespeople and customers, “We’re all in the same beat-up boat, and we’re all losing sleep at night.” RF

Steel Pricing Going Into 2021

Up to early May 2020 steel pricing for hot-rolled steel had been struggling to reach the historic average of $630 a ton since the China-U.S. trade war began to heat up in mid-2019. It had even dropped to $485 a ton at its lowest point in April 2020 before shooting up to around $1,000 a ton by the end of December 2020.

“It’s been A Tale of Two Universes,” said Steve Swaney, Flack Global Metals. “I mean, we’ve gone from one extreme to the opposite, from the beginning of the year to where we are today.”

And it’s still rising, but many believe it is near its peak. Once it stabilizes many experts expect it to hold for a month or two and have a gradual pull-back.

Pictured is a graph that reflects steel pricing since January 2018 showing the meteoric rise beginning in the last half of 2020 and continuing through the beginning of this year. This information, current through January 26, 2021, was compiled by Steel Market Update and used with their permission.

Originally published as “COVID’s Effect On Steel” Spring 2021 Rollforming Magazine.