Our Survey Results Provide Answers

■ Compiled by Sharon Thatcher

By the time you read this, hopefully the mess that so many people feared going into election day has been cleaned up. A quick and decisive win was not to be and we are likely to be mired down for a very long time in legal wranglings over election-result chaos.

The importance of election results was part of the concerns expressed by participants of a State of the Industry survey we conducted in late September and early October. We share the results below.

To set the stage, we had 45 people who took the survey. Of those, 61% were closely involved in the industry as either someone inside a panel roll-forming shop, a metal coil supplier, roll-forming equipment manufacturer, or metal roofer (the latter who increasingly operate portable roll formers). The remaining classified their association as either a building materials supplier, post-frame building contractor, metal-frame building contractor, or architect/engineer/consultant.

We would like to thank everyone who took the survey. As we go throughout the year, we hope to have more of you participate in surveys so we can provide additional insights into the industry based on your feedback. We do so in order to provide the best information we can about the roll-forming industry so it can continue to grow successfully and safely.

Here with the results:

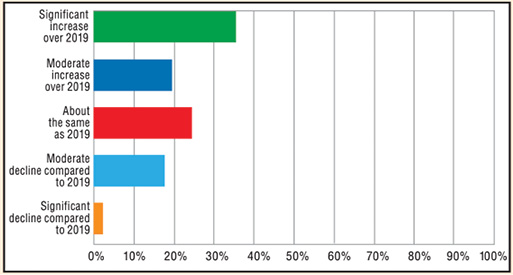

What do you expect your firm’s final contract

volume to be at the end of 2020 compared to 2019?

Significant increase over 2019 35.00%

Moderate increase over 2019 22.50%

About the same as 2019 25.00%

Moderate decline compared to 2019 17.50%

Significant decline compared to 2019 0.00%

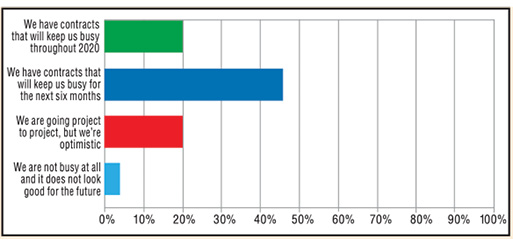

How much work is currently in your pipeline?

We have contracts that will keep us busy throughout 2020

22.50%

We have contracts that will keep us busy for the next six months

52.50%

We are going project to project, but we’re optimistic 22.50%

We are not busy at all and it does not look good for the future 2.50%

What are your employment plans for 2021?

We expect to hire additional personnel in 2021 55.56%

Our level of employees will remain the same in 2021 as 2020

33.33%

We will be reducing the number of employees we have in 2021

11.11%

Do you have any problems finding or keeping good help?

We do not have any problems finding good help 22.50%

We do have problems finding good help 75.00%

We rarely look for new help so it is not a concern 2.50%

If you have problems finding or keeping help, is your problem:

A lack of applicants. 35.14%

A lack of experience or technical expertise in the applicants

received 54.05%

Inability of applicants to pass screening process 16.22%

Work ethic, attendance or punctuality once hired 45.95%

Unrealistic salary or job expectations 5.14%

If you have workforce shortages, how are you dealing with them?

We are moving to automate more 23.68%

We are offering better wages and benefits 36.84%

We plan to grow less aggressively so we can use existing workforce

18.42%

We don’t have any workforce shortages 10.53%

We have other solutions:

-Subcontracting 15% of our work

-We are looking for employees at online job search websites

-Flexible hours and remote officing

-Continue to look for good people

The impact of COVID-19:

It didn’t impact my business at all 25.00%

It impacted my business for a couple weeks then

it returned to normal 45.00%

We continued in business, but there have been ongoing,

major disruptions 27.50%

Our business was closed and remains closed 2.50%

COVID-19 financial assistance:

We applied for a Paycheck Protection Program (PPP) loan, EIDL

loan or other federal program to help meet expenses during

COVID 42.50%

We did not apply for any federal programs but did rely on other

funding or financing alternatives to meet our expenses during

COVID 7.50%

We did not need a loan 50.00%

Do you have any expansion plans?

We are planning to expand our products/services in 2021 55.00%

We are planning to expand our products/services in 2022 or later

12.50%

We are taking a wait-and-see attitude about offering new

products/services 15.00%

We are not planning on expanding our products/services 17.50%

Equipment acquisition in 2021:

We are looking to purchase a new roll former 19.44%

We are looking to purchase a used roll former 2.78%

We are looking to refurbish or retool our current roll former 8.33%

We are looking to purchase software or controls to upgrade

our current roll former 11.11%

We are looking to purchase other metal forming equipment 36.11%

We are looking to purchase roll-forming associated equipment

like de-coilers, tippers or panel wrappers 11.11%

We are looking to purchase material handling equipment 19.44%

We are not planning on making any equipment purchases in 2021

44.44%

Priority of Concerns

The survey included a section where respondents could select, on sliding scales, the weight of importance they gave certain issues. They are listed below in the order of the importance they were given in the results:

#1: The presidential election

#2: General economic recovery

#3: Supply chain issues

#4: Government regulations

#5: Employee recruitment, hiring and/or retention

#6: Pricing by competitors or other firms

#7: COVID-19

#8: Raw material costs

#9: Labor and payroll expenses

#10: Freight and delivery prices

#11: (tie): Taxes

#11: (tie): Health care and benefit costs

#12: Mandated restrictions

#13: Equipment and capital goods cost

#14: Fuel and energy costs

What other concerns will

impact your success in 2021?

The survey provided an area for feedback on critical areas of concern. Respondents could write in opinions about what concerned them most. Again, the election had the most direct references, with employee issues and the general economy high on the list. Below are some of the individual responses we received, in no particular order.

• Free trade

• Less government involvement

• The hand of government interference is “always” a major

concern. The COVID rules are attempting to create a “new

normal” which is anything but.

• Consumer confidence in economy

• Potentially plummeting lumber prices

• Economic recession due to overpriced lumber

• A president that will be lead by the nose by the Marxists

• Keeping President Trump in office

• A Biden victory will ruin the economy

• Recession if Biden is elected

• Finding (and keeping) quality workers

• Slumping economy

• Government project slowdowns

• Governmental restrictions

• Unclear COVID-19 regulations

• Supply disruption

• Material costs

• Complementary business availability

(concrete work, electrical work)

• Natural disasters or other widespread or

even localized catastrophic events

• Negative press and constant negative talking. No one is

talking about the thousands of new jobs created worldwide

• Government spending and lack of tax revenue due

to COVID shutdowns

• Cash availability

Finally, one respondent thought we were out in left field with our survey, responding: “Your questions are off base. If you are in the materials business, COVID has placed you in overdrive. For some reason the makers of this [survey] thinks we have slowed down. Most questions do not apply.” RF