Shield Wall Media and METALCON conducted an industry survey that generated a lot of information, and we are providing a few of the basics here. Watch for our new Construction Survey Insights — Annual (a stand-alone magazine mailing in April) for more in-depth construction industry insights.

Shield Wall Media and METALCON conducted an industry survey that generated a lot of information, and we are providing a few of the basics here. Watch for our new Construction Survey Insights — Annual (a stand-alone magazine mailing in April) for more in-depth construction industry insights.

How did 2023 go for your business?

Did you hit your goals in sales and profits? Do you know why or why not? The whys and wherefores can be complicated, of course, but beyond glitches in production, the unexpected obstacles in purchasing, and missed marketing opportunities, not to mention everything that went well, do you have any idea where the industry is headed in 2024?

While no one knows for sure what is coming, taking a little time to size up where we are and what challenges are likely to present themselves can be helpful in planning.

The Construction Climate According to Economists

To the surprise of economist Anirban Basu, the economy continued strong in the third quarter of 2023. Contractors, he said, are very busy, in some cases too busy, and expectations are up for sales and profitability in 2024.

Basu said that there are many risks out there including inflation and geopolitical situations. However, we’ve been navigating well.

Job opportunities are spurred by economic transformation, Basu said. That translates to the rise of AI (artificial intelligence) creating the building of data centers, our e-com retail habits require warehousing, reshoring manufacturing to minimize the supply chain issues we’ve faced in the last few years requires manufacturing construction, and the infrastructure needs rebuilding and is now being financed. Therefore, there is a lot of opportunity out there, but alas, there is not enough labor to support all of it.

Youngsters, Basu said, are motivated less by money than previous generations. While they still have to pay the bills, they want more flexibility in their jobs and they want to feel like they are doing some good in the world. Give them a mission, Basu suggested. Whether it’s that your company is strengthening America through rebuilding the infrastructure or bringing manufacturing back, or whether it’s a focus on building safely or environmentally sound practices such as providing steel which boasts longevity and is recyclable — give them something to believe in.

Basu’s final advice for navigating an economy with so many unknowns is, “Don’t get complacent. Now is not the time to take a lot of money out of the business and build that $1.5 million house,” he added.

Ken Simonson believes that growth and job creation will continue in 2024, but at a slower rate than currently.

“I expect modest reduction in the inflation rate,” Simonson said, “not enough to get down to the 2% range the Fed wants to see before lowering its short-term interest rate target.

Simonson continued, “Both short- and long-term rates are likely to stay close to current levels or move higher. I don’t expect rates to end 2024 below current levels.”

Simonson believes that most supply chain disruptions have been remedied with the biggest exceptions in switchgear and other electrical equipment. He has spoken to people in the industry and he expects the shortages to last through 2024, which combined with labor shortages is likely to interfere with completion times on projects.

Shield Wall Media’s Construction Survey

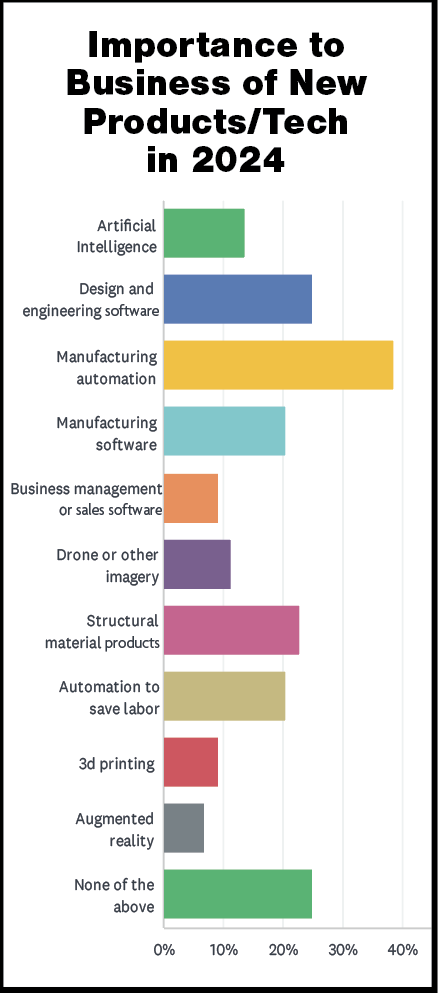

All of the graphs in this report represent the findings from the Shield Wall Media survey of industry insiders, which provides many interesting insights into the state of the industry.

For example, the “New Products/Tech” bar graph shows a breakdown of respondents’ expectations of being impacted by various new technologies. While it seems unsurprising that “Design and Engineering” and “Manufacturing Automation” would be important, “AI” is right up there, too.

Construction insiders Say:

United Steel Supply’s Will Waldrip said, “We are very optimistic about 2024 being another great year for the metal roofing industry. We think profits will be similar to 2023, but we expect industry growth overall which should result in a good year for most companies in our industry.”

From residential to agricultural, commercial, and industrial markets, Waldrip said that his team believes “all of these segments will be up for our customer base in 2024. The overall metal roofing industry gains market share every year,” which he added will create more demand for steel producers to supply.

Wayne Troyer of Acu-Form is also quite optimistic. “I am expecting our profits to rise at least 15% in the next year,” he said. He added that this will happen because he sees the prices of materials going down while efficiencies are going up.

However, he does expect a downturn in the residential market.

“Talking to builders in my area, including my son and son-in-law, all are saying that the only people having houses built are those that have cash because people can’t get loans. That’s a problem,” he said.

Troyer is expecting at least a 40% increase in agricultural work. He said prices are up for farmers right now, and with material prices coming down, lots of new agricultural builds will be going up.

The economy is trending upward according to Paul Zimmerman of Hixwood.

“We are seeing higher demand for our products and raw material,” he said. Therefore they expect profitability to be up in 2024.

Jason Smoak of SWI Machinery is cautiously optimistic.

“I think that our profitability will rise slightly in 2024, but there are a lot of factors at play in this equation. No one knows for sure how sales will go in 2024 with inflation and interest rates on the rise.”

In regard to interest rates he went on to say that they “seem to have stabilized for the moment and could possibly drop in 2024. Once they stabilize, people can plan on what their payments will be and possibly move forward with their projects instead of the uncertainty of wondering if the interest rates will rise before the project is finished.”

At the same time, Smoak said, “SWI is expanding in 2024 with the addition of a new facility in Peachtree, Georgia.”

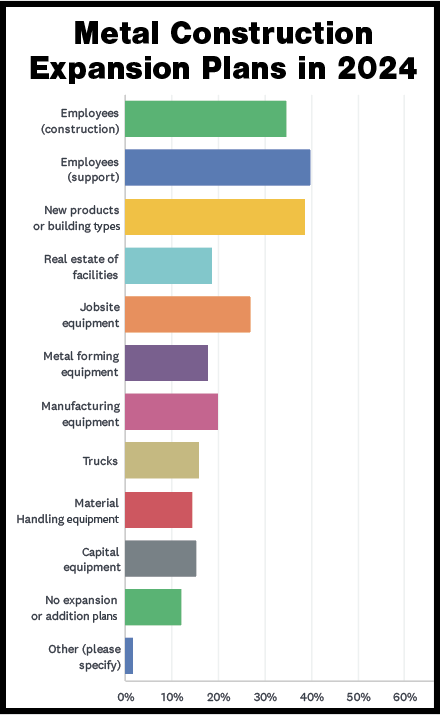

Plans to expand seem to denote confidence in the road ahead. According to the CSI survey, at least 40% of metal construction businesses have expansion plans for 2024. Check out the bar graph titled Metal Construction Expansion Plans for a breakdown of how they intend to expand.

Rough Spots Ahead

Our survey found that the construction industry believes the top five challenges for 2024 will be:

1. The cost of materials

2. Finding employees

tied with

2. Retaining employees

4. Inflation

5. Rising employee costs

It appears that the major concerns are with rising costs and employees, and interest rates didn’t even make the top concerns. (It came in at #6.)

Will Waldrip believes that supplies could be a big challenge in the first half of the year.

Wayne Troyer is concerned about interest rates and inflation.

Paul Zimmerman said that he believes that labor costs and interest rates will be the major concerns. Other concerns that he notes are that supplier confidence in the economy and that supply chains are not very strong.

“The supply chains are pretty good, but where I am seeing some change is that service centers and distribution aren’t as willing to stock as much inventory as they were pre-pandemic. I believe this is due to the high cost of interest rates,” he explained. “This makes downstream manufacturers need to stock more.”

Smoak said that inflation, the cost of materials, finding employees, and interest rates are all likely to be problems in the coming year. He added, “Inflation and interest rates are they only two things you have no control over. Employees could possibly be replaced with automation.”

“I think automation will continue to grow for us in the future,” Smoak said. “This is due to inflation, cost of materials and how difficult it is to find employees. Automation is advancing pretty quickly these days and becoming more reliable, so if someone can automate a normally labor-intensive process it can help them stay competitive.”

Troyer said that automation is going to be very impactful in the coming year for many companies for that very reason.

“It can offset the lack of workforce, so if the process is fully automated, one person can do more. We won’t be impacted at Acu-Form,” Troyer said, “because we are as fully automated as possible, and we have backlog to fall of 2025.”

The Final Word

Brian McLaughlin, National Sales Manager at Drexel Metals, said, “We see opportunity. The metal roofing industry is interesting as no manufacturer has market share. Instead, it is a fragmented, regional industry with many players. And while some are viewing 2024 as bearish due to rising interest rates (there may be some truth to that), activity in bid work and design work remains strong. This gives opportunity to metal roofing manufacturers to grow market share. Setting your company apart from the many competitors by providing the best service to customers will always be a winning strategy.” RF