by Sharon Thatcher

In speaking with rollformers and their suppliers during preparation for this issue of Rollforming Magazine, optimism has been running high throughout the country for 2022 to be another good year. A typical slowdown between fall and winter seemed only a blip on an otherwise upbeat trend.

Steve Swaney, Sales & Business Development, Flack Global Metals, monitors the steel market on a daily basis and offered the best news in a long time: a prediction for steel prices to ease back on the accelerator for the first time in months. The trend has already begun, with a greater leveling out anticipated in the months ahead.

“The industry is in a flux again and pricing on steel is headed down,” Swaney said in late October. It hadn’t yet reached coil buyers, however. “Right now the going price for steel is still very high,” he explained, “but the pricing for incoming import steel for the first quarter of 2022 is less expensive which will in turn put pressure on domestic mills to adjust their pricing going into 2022.”

The drop should eventually make its way to rollformers by year’s end and into 2022.

At the time of our conversation, galvanized and Galvalume were selling near the $2,100 a metric ton range. Swaney said to expect a drop to the $1,600 to $1,650 a ton range in Q1 2022, with further decline gradually into the second half of the year.

Helping to hold back price reductions for coils more recently were increases in paint for pre-painted metal.

Any current softening of prices is likely the result of coil buyers trying to reduce inventory by year’s end to reduce inventory tax consequences and take advantage of more cost-effective inventory next year.

Coated steel is expected to eventually recede to around $1,400 a ton before settling there.

At its lowest in early 2020, steel was in the range of $500 a ton, with year-end prices at $952-$1,000 a ton, but don’t expect those kinds of prices again. “It’s still going to be much, much higher than where we were in 2020 and no one expects it to get back to that point,” Flack noted.

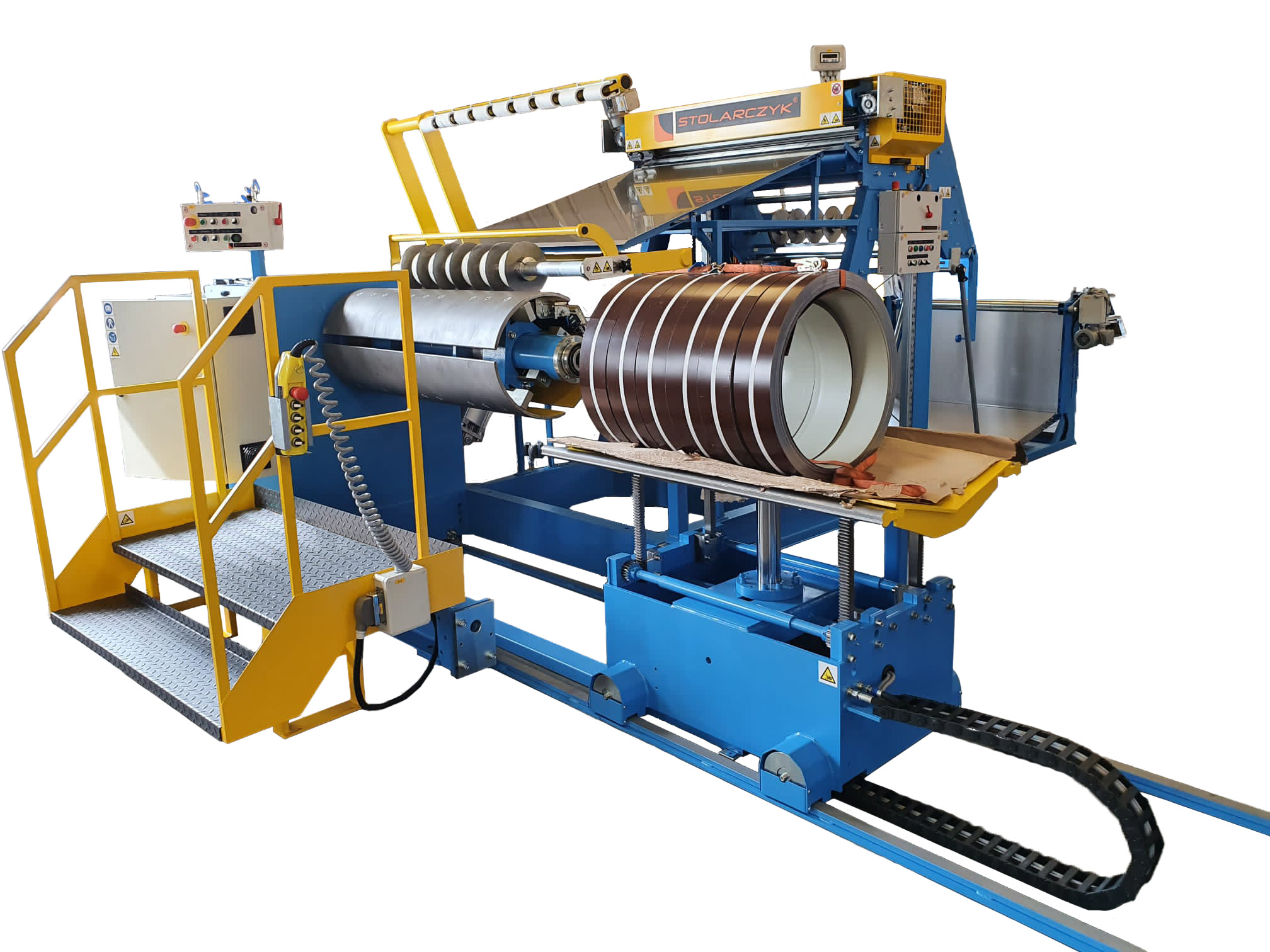

Despite high prices in 2021, demand remained strong and coaters are still very busy trying to catch up, as are processors for slit coil and cut-to-length. Currently lead time is about 25% longer than normal. “A coil coater takes typically two to three weeks. They are probably running now four to six weeks,” Flack said. “A slitter is normally one to two weeks. Most of them are running now anywhere from three to five weeks.”

A Return to Options

You can expect more leeway and freedom in what products you offer your customers in 2022. During the past year, buyers have been restricted to standardized volume colors and in some cases restricted wider widths based on what the mills were willing to produce. “[Coil buyers] couldn’t get some of their more outlying colors because [coil suppliers were] pretty much stocking the very basic, larger-volume colors,” Flack said. “We think going into next year [coil buyers] will actually get more latitude and availability of anything they want. It will shift to more of a buyer-friendly market. We think that will happen mid to late first quarter.”

Aluminum Pricing Now Much Higher

On the other side of the spectrum is aluminum where prices are at record level and availability very limited and expected to stay that way through most of 2022, with pricing expected to moderate some in the second half of the year. Insufficient domestic capacity coupled with tariffs and duties keeping some large producers such as China out of the supply chain, along with higher usage in the transportation and aerospace sectors forecasted for 2022 and beyond, have created a major shortfall. An announcement in late October by President Biden that there would be some easing back on tariffs for both aluminum and steel is not expected to affect the construction segment.

Until recently some aluminum building products were being substituted for light gauge steel as the cost per square foot was less, now steel will have the advantage in 2022 and might flip some things over to steel where either is acceptable. High energy costs to make aluminum, and shortages in magnesium will hold pricing up to reasonable levels for the short term.

“There’s just not enough electrical power [worldwide] for mills to feel they can afford to run a lot of the aluminum,” Flack explained. As a result, less of it is being made. “Whether [aluminum mills] will eventually try solar panel or wind power to generate some of their own electricity to help drive down their cost, something needs to be done. And none of that can be a short-term solution. It’s a minimum of a three- to five-year transition.”

Common alloy aluminum was trending at over $2,800 at the time of this writing.

Regional Trends

From a regional perspective, Flack has witnessed some areas doing much better than others. “The construction sector in the Sun Belt and the West Coast seem to be much stronger,” he said. “We’re seeing more of a slowdown in the Upper Midwest and Northeast right now.” He attributed some of the slowdown to the initial onset of winter and changes in weather, but also some “sticker shock” by end consumers.

The slowdown is expected to be relatively brief, however. “They’re still predicting that residential construction could be up 10-15% [next year],” Flack said, “with pricing going up even further than what it did this year … both for pre-owned and new construction.”

Guidance for rollformers

Flack Global is telling its own buyers to only buy what they can sell between now and January, then start stocking back up in the first quarter of 2022 when prices start going down.

At the Steel Summit meeting in August, hosted by Steel Market Update, Flack said industry experts were predicting a strong 2022, with some recessionary activity potentially in the second half of 2023. “Those guys are normally fairly accurate in their predictions,” he noted.

Flack also said rollformers should be encouraged by how well roll-forming equipment manufacturers have fared, and even flourished, during the upheaval of 2020 and 2021. “There’s continued new machinery coming out that’s enhancing operations for the rollformer, streamlining their operations, allowing them to make more consistent and better products. There’s a lot of investment in that now,” he said. “I think a lot of people felt, with the price of metal going higher and higher, there would be less investment because they would be squeezed for cash flow, but that hasn’t been the case.”

North American Mill Expansions

Several North American steel companies are in the process of adding production. While some of these projects are not directly aimed at steel for the construction market, any new capacity will help to ease overall supply constraints.

Blue Scope has new capacity expected to come on stream in Q2 at its North Star steel mill in Ohio.

Big River Steel, now part of United States Steel Corporation (US Steel) has a major expansion underway in Arkansas, which should be finished mid-year 2022.

US Steel has also committed to a new a mini mill at a site yet to be announced, with construction to begin in the first half of 2022 and production expected to begin in 2024.

Steel Dynamics has announced plans to expand at its Terre Haute, Indiana, facility as well at its Pittsburgh Techs Division. Some production at its new Stinton, Texas EAF operation went online in 2021, but weather delays has put behind the opening of the primary facility, now expected to come on stream in the second quarter of 2022.

Nucor has plans for a new steel sheet plant in either Ohio, Pennsylvania, or West Virginia.

Ternium and Arcelor Mittal are committed to expansions in Mexico, which feed into the U.S. market.

All the North American mills on the drawing board are electric arc furnace (EAF) mills using recycled steel for new production.

On the aluminum side, no new capacity is expected. RF