By Gary Reichert

One of the unique things about my position is I have the opportunity to regularly communicate with many people in different segments and strata in the construction industry. My conversations include marketing and advertising, but also other topics related to general and specific events affecting our world. The specifics of these conversations are always confidential, but they allow me to aggregate information relevant to our portion of the construction industry. Without violating confidences, here are some takeaways based on our surveys and my conversations. Please understand that these are opinions and anecdotes. The information is possibly inaccurate and is being presented for consideration only. Do not base any business decisions solely on opinions expressed in this article without verification through other sources.

In no particular order, some thoughts about the upcoming year.

Machinery and capital goods manufacturers are doing very well. Demand is up and lead times are longer than typical. For some products lead time is running a year or more. Typical lead times used to be 3-6 months. This is good for the manufacturers and a sign of general optimism because these are expensive durable goods that depreciate over a period of years. A company is not going to make a large investment in capital equipment unless they believe the economy will support the investment over time. A lot of people must believe the increased demand will continue for the next 3-5 years, or longer.

The supply chain is facing challenges at multiple levels with different underlying causes. Essentially it is a mess. Everything from shipping to labor shortages is affecting the availability of products. This creates short-term uncertainty and makes it difficult to forecast and predict cash flow. In larger companies this may represent a larger challenge and cause them to be conservative in the short term. With additional levels of management, reacting to change takes more time and there is a greater aversion to risk. Indications seem to be that this will lessen after first quarter.

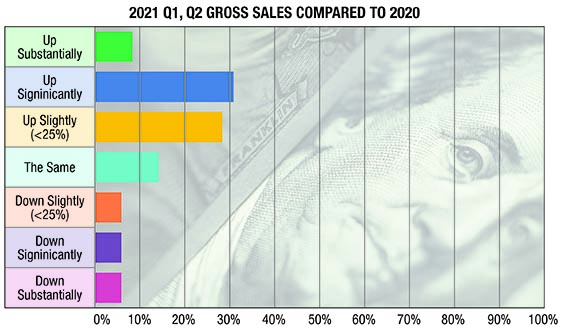

Generally the business climate is good and most people I speak with believe 2022 will be similar to or up from 2021. Most of the businesses experiencing challenges seem to be suffering supply chain issues and are unable to receive or ship product. Demand is high and the increased material and labor costs have not driven prices up to the point where it restricts demand.

Energy and fuel costs are an issue, but do not seem to be a major damper on business as they are just passed through the supply chain to the end user, and the tipping point where it affects demand does not appear to have been reached.

The labor shortage is a continuing challenge. This may lessen, as the government is cutting back programs that subsidize workers staying home and COVID recommendations change. Interestingly, I read an article recently that asked, “How long can Americans afford to not work?” That topic being discussed in conventional media makes me hope that we are nearing the end of this obstacle.

Political instability, COVID policy, a looming election year, possible interest rate hikes and ongoing mergers and acquisitions introduce an aspect of uncertainty. As a rule, uncertainty limits expansion and capital investment, but our industry seems to be running counter to that trend, primarily because demand is high.

I am only in the business of making predictions about my own business. I would not recommend anyone taking my opinions too seriously. We have many reasons to be optimistic about 2022. The possibility of labor returning, shipping and supply chain issues resolving and high demand continuing may make 2022 a very interesting year — in a good way. RM