Steel-industry icon cautions metal industry leaders—don’t drink the kool-aid. Tough talk at METALCON. Hoping to improve our global competitiveness.

Former CEO of Nucor Corp. and senior trade adviser to President Donald Trump’s Campaign, Dan DiMicco, defended the Trump administration’s aggressive foreign trade policy and tariffs in his keynote address, “The Economic Plan for Growth and Global Competitiveness in the United States—Implications for Steel” recently at METALCON in Charlotte, North Carolina. He explained how steel and aluminum tariffs are necessary, make sense and are putting the United States back on track.

Fighting For Steel & Manufacturing

DiMicco, Charlotte’s best-known advocate of hardline trade policies and chairman of the Coalition for a Prosperous America, said he is not only at the forefront of fighting for steel but also for manufacturing.

DiMicco says, “Trump is a unique guy. He is not a politician, and it shows. There are things people like about him, and things people don’t like about him. What I am here to talk about today is what he is doing to improve our global competitiveness. That is why I joined his team on trade as a strategic economic adviser.”

“Trump’s economic policy has the economy firing on all cylinders—wages are starting to go up, and unemployment rates are down,” said DiMicco. “Our four-point economic plan the President outlined during his campaign is very straight forward. It involves tax reform, trade reform, regulatory reform and energy reform. It also involves rebuilding our infrastructure. Each reform is significant by itself. The beauty of the four-point strategy is the synergies that take place when you execute on all four together—all designed to improve our global competitiveness. As the President has said, the United States is open for business again. Build your plants here. Grow your facilities in the United States to serve our market and to export to the rest of the world—not the other way around.”

The United States Is Open For Business

“For the last 25 years, China has been waging a trade war against the United States,” said DiMicco. “A lot of us have been fighting that war but without the resources to win it, until now. The American people have said enough is enough. This administration is saying enough is enough.

“We believed when we allowed China into the World Trade Organization to gain permanent nation favored trading status, that they would live up to their promises—their promises to be a market-based economy,” said DiMicco. “They did just the opposite for the last 25 years.

“What drove this home most recently was, Chairman Xi, now China’s emperor for life, came out with his China 2025 policy, and his words were, ‘China 2025 is about us dominating the industries of the future, not being a global trading participant with the rest of the world,’” said DiMicco. “He even scared a lot of the leaders in China, but what he also did is make the rest of the world stand up and take notice. They don’t want to work with the world as they promised; they want to dominate and control. To do that, they have to undermine the United States, and we have allowed them to do that.”

Trump: Enough Is Enough

“What this President is saying, is enough is enough,” said DiMicco. “We’re not going to take it anymore. We are going to fight back while we still have the leverage to do it, and we have lost a lot of leverage, make no mistake about it.

“So, what is the administration doing?” asked DiMicco. “You have heard about 232 (of the U.S. Trade Expansion Act of 1962), and you have heard about 301. A lot of people have mistaken that the 232 program is designed just for steel and aluminum. That’s completely untrue. There are nine strategic industries. Steel and aluminum were just the first because they have been under attack the longest, but the 232 program is about national defense. You cannot be a leader of the world if you don’t have a strong manufacturing base and a strong steel industry.

“We need a global trading system that is reciprocal, fair and balanced,” said DiMicco. “We’re not against China having economic growth, providing for its people, having a strong middle class in China—just the opposite. Everybody went into this with the idea that that’s what would happen. The problem is the opposite has happened.”

This Is About The Future Of Our World

“The world has got a serious problem,” said DiMicco. “The world cannot afford for the United States not to be there as a counter balance and stronghold. This is much bigger than any one product, any one industry. This is about the future and well-being of our nation and our world.

“You know the supply chains, where they are and where they are not,” said DiMicco. “Our defense department says we can no longer supply parts we need for our military. They did a study and went down five levels in the supply chain and said we are getting our stuff from people who don’t like us, the people who want to destroy us. This can’t be like this. We have to re-establish our supply chains. Otherwise, you don’t have a manufacturing sector that stands on its own two feet.

“Whether you like Trump or not, this is about something bigger than one person; it’s about the future of our country… it is about more than one industry and more than one country,” said DiMicco. “This nation is at a crossroads. We have been under attack by an economic aggressor who has one thought in mind—to dominate, not to share, but to control. We have no choice but to engage in a war that has been waged against us. We may not like it—the way it affects our businesses—but this is a bigger issue. You can choose to be a champion for us; you can choose to be a champion against us. Enough is enough. We want China to be successful, but not at our expense or at the expense of the world. And, you can’t have national security without a strong economy.

“You think we’re going to change this giant battleship of a trade war overnight?” asked DiMicco. “It is going to take years. It is not going to go away until China fundamentally changes the way it does business with the world. There’s no shortcut. All we can do is support the President until the Chinese sense our resolve.”

Stop Drinking The Kool-Aid

Following DiMicco’s presentation, audience members participated in an interactive Q & A session. When one audience member repeatedly contended how it was hard to justify making manufacturers and other countries suffer the burden of tariffs as a tactic against China, DiMicco replied, “It is absolutely necessary, and I already made my case for it.”

When this same audience member persisted, stating Chinese companies were a true economic player out to make profits like everybody else, DiMicco stated the government subsidizes their energy and materials costs, allows them to avoid environmental costs imposed in other countries and allows them to exploit their workers in ways that are not allowed in market economies. DiMicco abruptly wrapped up the back and forth discussion with, “You need to stop drinking the Kool-Aid. We need to give the microphone to somebody else. Take the Kool-Aid away from him.”

DiMicco, author of American Made: Why Making Things Will Return Us to Greatness, spent most of his career in steel and manufacturing. He served as a senior trade and economic adviser to President Trump’s campaign and was the lead on the U.S. trade representative transition team. He joined Nucor in 1982 and worked his way up to president and CEO in 2000. Under his leadership, Nucor delivered dramatic growth in profits and shareholder returns. Today, Nucor is the United States’ largest producer of steel and also considered North America’s largest recycler.

Critical To The Metals Industry

“Dan’s tariff talk was so critical for our industry,” said METALCON show director, Claire Kilcoyne. “His extensive knowledge and first-hand expertise on this subject was incredibly informative and enlightening. It was an engaging program, and he got everyone talking. It is important to understand what’s truly going on in this trade war and to avoid drinking the Kool-Aid.”

They say change is good; well that’s great for the steel industry because there is a lot of change ahead. What does this mean for the roll forming industry? Time will tell, but if change is good, then the same holds true for this booming industry as well.

Metal Rollforming Systems (MRS), based in Spokane, Washington, agrees. “A single word can sum up the current state of our industry, change,” says Bill Griffin in his blog on their website.

The metal construction industry is changing. The metal industry is a booming marketplace filled with double-digit growth, new and exciting products, all while simultaneously facing uncertainty in the global steel supply market.

Startup companies are taking advantage of low-interest rates while existing companies are capitalizing on new equipment to reduce labor costs and maximize profit. Both new and existing are finding a glut of construction spending combined with changes in the tax laws are yielding some of the best margins seen in years.

Steel And Supply

The looming question on everyone’s mind is what will happen with steel prices? While no one knows for certain what the future will bring, the tariffs announced on the importing of steel to the United States have raised the price for coil.

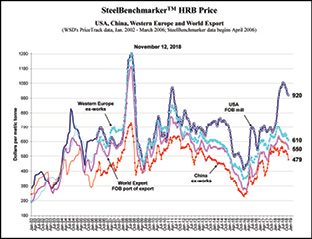

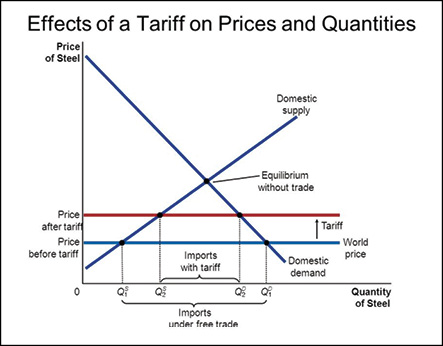

As shown in the chart on the previous page, the price between domestic and import steel has trended relatively similar. With the announcement of the tariffs the gap has widened with domestic mills recognizing the opportunity to push for more margin. Fortunately, many of our trading partners have been added to the exemption list; European Union, Argentina, Brazil, South Korea, Australia, Canada and Mexico have all been added to the exemption list. This should calm down the market and bring supply in line with demand.

Bret Curtis, president of United Steel Supply, was kind enough to share with MRS a few of his thoughts on the subject.

“The steel markets in the U.S. rarely see the type of strength in price and chaos experienced since early 2018. Initially instigated by higher oil prices and the very robust oil & gas markets, hot rolled prices strengthened from end of 2017 through mid-February. Pipelines and growth of rig count created strong demand for hot rolled leading to price increases of more than $110/ton from December until February. Then, things got very busy. On February 16, the U.S. Department of Commerce referred to the Section 232 investigation and announced very strong recommendations to the Trump administration that high duties and/or quotas be administered on imports of all steel and aluminum to the United States. This announcement sent anxiety into the market and completely stopped offers of steel from overseas. On March 8 President Trump confirmed that the United States would enact 25 percent duties on all imports of steel and aluminum. This sent the market into hyper drive. Due to the apparent lack of import offerings, and the immediate effect of a 25 percent duty on imported steel, the U.S. mills were all immediately inundated with demand from buyers.

Since the President’s announcements on March 8, there have been some countries, which have been exempted from the Section 232. Canada, Mexico, the European Union, Brazil, Argentina, Australia and South Korea. However, quotas for supply from some of these countries will continue to dramatically reduce supply of steel in the United States.

Not only have prices increased dramatically, demand has grown. The United States does not have sufficient capacity to meet demand for steel, thus imports account for approximately 30 percent of total supply of steel in the United States. The buyers who would normally buy import have worked to purchase domestic U.S. steel; however, there is not enough production to cover everyone’s needs, thus U.S. steel mills have full order books; and many buyers are left with booking imported steel, even with a 25 percent duty attached to it.”

Effectively the tariffs have reduced the available inventory, thereby increasing the cost of steel. Fortunately, with a strong economy and a growing housing and construction market the increased steel costs have, in most cases, been able to be passed on to the consumer. This varies by region but every manufacturer in the United States is facing similar supply-side challenges.

Demand

The construction industry is growing at a pace that hasn’t been seen in years, according to MRS. With used housing inventory availability at an all-time low, new houses and remodels are more prevalent than ever before. Metal roofing continues to carve out a larger market share, growing at an exponential pace. As new products, profiles and design ideas emerge, the existing infrastructure will struggle to keep up. It is only with new capital investment that the industry will be able to meet the growing demands.

Need For Capital Investment

As prices continue to climb for both labor and raw goods, companies look to new ways to maximize margin and reduce costs. The cost for manufacturing labor continues to rise in the United States, by over 20 percent in the last 10 years. One of the most labor-intensive areas of the metal roofing industry is trim manufacturing. With each piece needing to be handled and positioned multiple times, the labor burden on trim adds up quickly. Most companies also find that trim production becomes a bottle neck to overall business growth and production.

For more information on Metal Rollforming Systems, contact www.mrsrollform.com.

U.S. Department Of Energy’s Take On The Importance Of Steel

As explained by the U.S. Department of Energy, the steel industry is critical to the U.S. economy. Steel is the material of choice for many elements of manufacturing, construction, transportation and various consumer products. Traditionally valued for its strength, steel has also become the most recycled material. It is estimated that approximately two-thirds of the steel produced in the United States per year is made from scrap.

Steel-making facilities use one of two processes. In the integrated steel-making process, iron is extracted from iron ore in the blast furnace and the molten product is then mixed with recycled steel and refined with oxygen in the basic oxygen furnace (BOF). In electric arc furnace (EAF) steel making, recycled steel is the primary input (virtually 100 percent), although other iron-bearing materials may be used. The less energy-intensive EAF process accounted for about 62 percent of U.S. steel making in 2011.

Large quantities of low-cost imports have challenged the industry in recent years, but restructuring, downsizing and widespread implementation of new technologies have led to vastly improved labor productivity, energy efficiency and yield.

The industry employed more than 135,000 people working at 100 facilities in 2010. As a result of industry consolidation, the number of steel-making facilities has decreased significantly over the last few decades. The highest geographic concentration of mills is in the Great Lakes region, including Indiana, Illinois, Ohio, Pennsylvania, Michigan and New York.

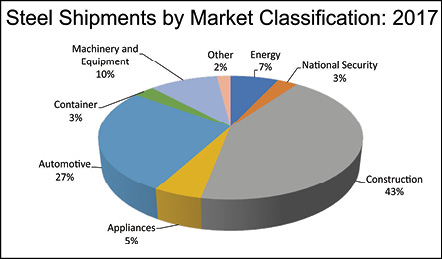

Markets

The U.S. steel industry is vital to both economic competitiveness and national security. Steel is the backbone of bridges, skyscrapers, railroads, automobiles and appliances. More than 3,000 catalog grades of steel are currently available, not including custom grades for specific uses.

Production

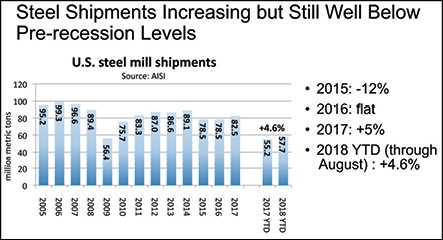

The United States historically produced an average of 106 million short tons of steel (2005-2008). After a decline in response to the economic recession of 2009, the industry is recovering.

Energy

The U.S. iron and steel industry relies heavily on coal and natural gas for fuel, and is one of the largest energy consumers in the manufacturing sector. In 2006 the industry used 1.48 quadrillion Btu of primary energy (excluding feedstocks), amounting to $6.69 billion in energy costs for heat and power. The industry has made significant improvements in energy intensity over the last decades, reducing energy use per unit of output by about 30 percent from 1990 to 2009.

According to the Indiana Business Research Center, changes in the health of the steel industry nationally can be expected to drive changes locally, and understanding the national setting has clear importance. Looking initially at the extent of competition in the U.S. steel industry, the center recently did a study on the transition from an oligopoly to a competitive global industry.

They examined capacity, output and output use trends. They studied how prices have changed over time relative to prices in general. They considered how changes in price, national income and the prices of competing products have affected the demand for U.S.-produced steel. They also considered how the steel industry has been restructuring, and they looked closely at the future of the steel industry. Their primary concern was to describe the changes in detail, rather than undertake a search for their causes.

The Extent Of Competition

Competition within an industry has important consequences. The greater the extent of competition, the greater the pressures on firms to operate efficiently, the less control firms have over price, and the lower the average rate of profit is likely to be. Two measures are generally used to indicate the extent to which an industry is competitive: concentration ratios, which measure the share of the market that belongs to the largest firms, and the Herfindahl-Hirschmann Index.

In 1970, the steel industry was difficult to classify, but it was not highly competitive. The four largest firms—U.S. Steel, Bethlehem Steel, Republic Steel and National Steel—probably had some degree of market power and some ability to use price as a competitive weapon. By 1997, competition in the steel industry had increased substantially, even without accounting for import competition. The steel industry in the United States is now substantially competitive, with no firms having any significant control over price.

Present Condition Of Steel Market

Some examples of current national economics statistics from the U.S. Census Bureau, Blue Chip indicators, FMI and other market sources include:

Construction

• New housing starts increased to 1.21 million units in 2017—and are expected to further increase to 1.28 million units in 2018 and 1.32 million in 2019;

• Nonresidential building construction continues to grow but is likely beyond its cyclical growth peak;

• Value put-in-place fell from 13 percent growth in 2015 to 3 percent in 2017. It is expected to average roughly 6 percent growth in 2017 and 2018;

• Nonbuilding structures (infrastructure) fell 6 percent in 2017 and is expected to grow 1 percent to 2 percent in 2018 and 2019. Any prospective significant infrastructure spending program appears unlikely to materially boost construction spending before the end of 2019;

U.S. Economic Conditions

• Real Gross Domestic Product (GDP) grew at a 3.5 percent annualized rate in 2018Q2 according to the Bureau of Economic Analysis as of Oct. 5;

• The latest consensus forecast calls for real GDP growth of 2.9 percent in 2018 and 2.6 percent in 2019.

Economic strengths include: high optimism, continued strong labor market (September 2018 unemployment rate at lowest since 1969), business investment recovery in part due to tax code changes.

Concerns include: rising interest rates, rising wages and labor shortages in a very tight job market, U.S. dollar climbing again after depreciating in 2017.

Steel Markets & Steel-Using Sectors

According to the U.S. Department of Commerce compiled by the American Iron and Steel Institute (AISI):

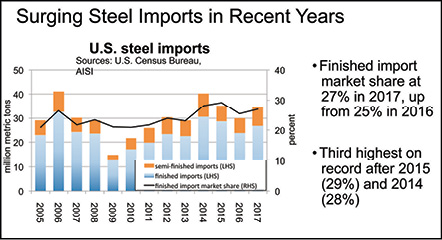

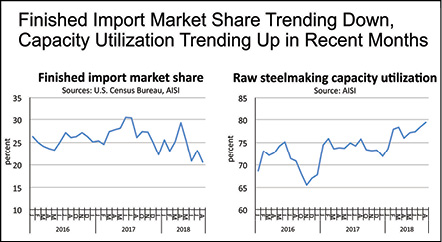

• Imports: Steel imports have declined

40 percent between April and September 2018;

• Finished imports are down 35 percent over the same time period, with finished import market share falling from 29 per- cent in April to 21 percent in September;

• 2018 YTD (through September) vs. 2017 YTD: Total imports: -12 percent; Finished imports: -13 percent; and Finished import market share: 24 percent in 2018 YTD vs. 28 percent 2017 YTD.

According to AISI, also:

• Shipments: U.S. steel mill shipments up 5 percent in 2017 and 5 percent in 2018 YTD (through August), due to improved demand and trade environment;

• Despite rebound, shipments still tracking below 2012-2014 levels and well below pre-recession levels.

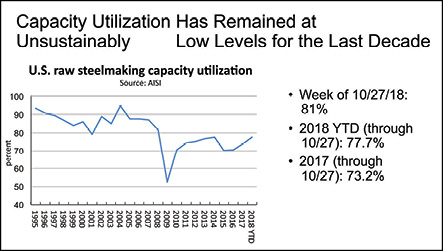

• Capacity utilization: Trending upward due to improved demand and trade environments, reaching 79.6 percent in September;

• Substantial improvement from the 60 percent levels during the height of the import surge in early 2016, but still below average utilization rates consistently reached prior to the Great Recession, which were in the mid-to-high 80 percent range and occasionally higher.

Robert J. Wills, P.E., vice president of construction market development of the Steel Market Development Institute, a business unit of AISI, in Washington, D.C., says that there is a lot of change currently happening in the steel industry and he is positive looking at the future.

“It definitely is very interesting. The industry has been strong in the past six months; we think it’ll be a good year. It won’t be a great year; it won’t be overwhelming, but it will be positive. For 2019, there are a lot of variables that could have a lot of impact.”

Becoming More Competitive

When asked if the whole steel market is growing in size by becoming more competitive with asphalt, Wills agreed wholeheartedly.

“Absolutely. Metal roofing is definitely doing the right things to advance the market. And, steel is a much better product for roofing than competing materials like asphalt. Just looking at the lifecycle of steel, it’s much greater.”

Education Is Key

Wills, who is currently building a home in Alabama, is putting a metal roof on the newly-constructed home.

“I am buying the roof that I believe in and it is going to look great on my house.”

Wills is also on the Metal Roofing Alliance (MRA) board and he says that they are doing a great job educating the public about the benefits of metal.

“Organizations like the MRA, MCA [Metal Construction Association] and the NFBA [National Frame Builders Association] have all done a wonderful job over the years educating and promoting the benefits of metal and it has been great for the industry, and it is paying off,” he said.

When this article was written, all of the charts presented in this article were up-to-date, however, this data is updated on a monthly basis. RF

- Audience members at METALCON were engaged during DiMicco’s presentation. His extensive knowledge and experience was well received and had a positive response from expo attendees.

- Following DiMicco’s presentation, audience members participated in an interactive Q & A session.