By Sharon Thatcher

One of the most effective ways to improve your profitability is to improve your inventory management. Originally, the only option for knowing how much of what you were receiving, producing, and shipping was via low-tech pen and paper accounting. While there are companies still operating at this level, product demand colliding with a worker shortage is pushing many roll formers in the direction of new ideas to grow and prosper. Three options that are proving to be popular with construction roll formers include machine control upgrades; software upgrades; and online procurement.

#1

Machine Control

Upgrades

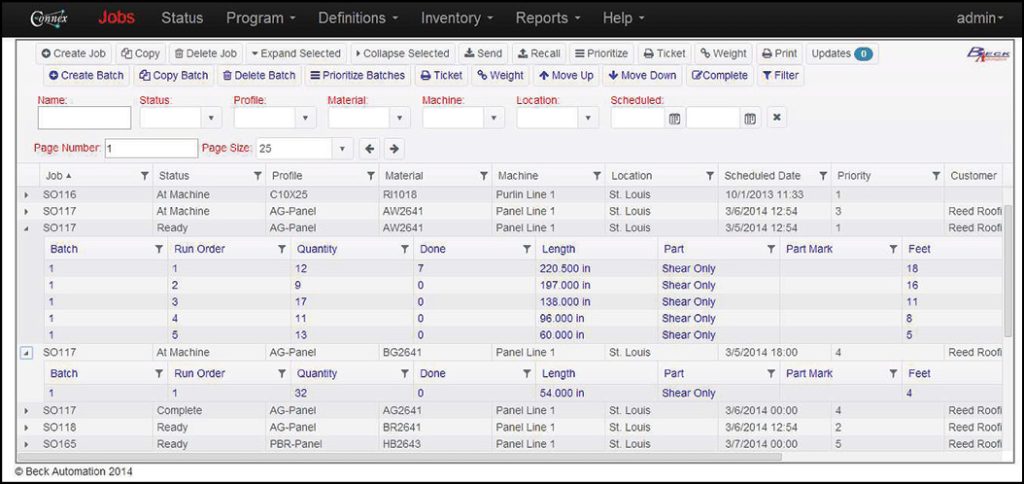

Although inventory management starts before production, the production phase is often where the main focus is targeted. For that reason, an after-market machine control upgrade is frequently considered a first-step solution. There are two major players in that space for metal construction roll formers: Beck Automation, which offers its Connex system, and AMS Controls with its Eclipse system.

Zach Beck, in sales and marketing for Beck Automation (www.beckautomation.com; part of The Bradbury Group), says there is a noticeable trend towards control upgrades, and for legitimate reasons. The first is due to the advancements offered.

“Although some people will buy a new machine and have our controller installed immediately, generally what we do are retrofits,” Beck explains. “Maybe someone has an old machine but it still makes good product. They want to know what they can do to improve the efficiencies of the machine, and what they can do to streamline their process.”

The controller transforms the roll former from a machine with simple on-off controls to a computerized smart machine, advancing its ability to precisely measure and track coil usage.

“Anything that happens while that coil is tied to that machine, it’s going to be tracked to that coil,” Beck notes. “For example if I produce good material with this coil, it will say I produced good material with this coil. If I produced scrap, it says it produced scrap.”

Having that information is powerful, allowing the owner to hone in on problems that can be corrected.

“There are multiple reasons for why you generate scrap,” Beck says. “There could be forklift damage, or maybe there was bad paint, or other imperfection with the coil. For example how or where the coil was stored. The benefit of tracking is, now there are things I can do to improve my inventory. I can change how I’m storing my coil, how I’m loading the coil onto my machine, or maybe I change my vendor to get a better quality coil and improve my final product.”

Beck offers a common scenario of how the controller works on the job to prevent error. “A loader loads a coil onto a machine, and enters the coil information into the controller manually or through a barcode scan on the coil. When that operator hits ‘line start,’ we can look into Connex and verify the coil’s material: for instance, I have lot No. 123, the coil’s color is red, it’s 29 gauge, it’s 43 inches wide. We look at the order and see what material is supposed to be assigned to that job. If those two don’t match, we can tell the operator, ‘nope, you loaded the wrong material.’ And by doing that, you’re going to prevent running too much scrap, wasting material.”

Three levels of control

Although add-on machine controls offer a major step in automation, it is just the beginning. While the software built into the control is devoted exclusively to machine use, available are further auxiliary software upgrades that offers machine owners even more management control. Step 2 includes the installation of software that can track coil information when the coil is off the machine, such as initial footage and remaining footage.

In explaining the benefits of Step 2, Beck says, “Your inventory management is really two sides: what do I have in inventory and what could I use that material for? Did I run this coil on this job? Or if a customer calls in and says they had an issue — a warranty claim — you can track back to what coil that job was assigned to.

“Step 3 is the integration of accounting or ERP software that ties all of your office, shop, and shipping systems together. It’s having the software in the office so it can be communicated to that controller,” Beck says. “The information is input once, and tracked as it goes down to the plant and back, from issuing material to closing the order in the ERP software.”

In other words, it can follow every single coil throughout its lifespan at the roll-forming shop.

A Matter of Preference

The level of automation is still quite diverse throughout the regional roll-forming world, although Beck sees increasing interest in both adding after-market machine controls and then further integrating it with ERP and accounting systems.

“Companies realize the time savings,” Beck says of the totally integrated system. “They see that, now I’m entering the order information one time and I’m not having to re-enter that; it saves scrap, saves errors. If a customer calls in and says, I need 10, 12-foot pieces, and someone inputs it instead as 12, 10-foot pieces, that could end up as a lot of scrap. The more times I have to manually input information, the more times I have a chance of entering the wrong information.”

He doesn’t see that trend for total integration changing any time soon. “There will always be people who feel more comfortable with some sort of a paper trail but as the younger generation gets into the business more and more, they will want to make it completely paperless. They’re going to want orders based on what the machine’s capacity is and want the software to have input on what jobs and orders are sent down to the machine.”

That’s the production side of it, but it extends to the inventory side as well. Of the next generation of roll-forming shop owners he says: “I think they’re going to want integrated software for inventory tracking. They’re going to want it to be where they can more easily see their history: What do I need to have in stock based on historical values — what did I run last year, last month; how much material do I need to order; what percentage of increase can I expect, and how much material do I want on hand?”

The capability to do that is already available — the future is now — but Beck predicts it is 10 years away for businesses both large and small to accept it as commonplace.

Until then, every business owner will need to decide if and when a machine control upgrade is wanted or needed. Beck says the first step is for owners to understand what is available, and sit down with after-market control manufacturers to discuss present and future business needs. “I always like to ask a [potential buyer] what are you doing today, what are your sticking points, your log jams, what things do you really need to improve, or want to improve?”

#2

Software Upgrades:

Office to Machine Integration

As Josh Beck indicated above, the ultimate platform, or Step 3, for roll-forming businesses is to completely integrate office and machine systems. This allows everything to flow through a single system from sale, to inventory, to production, to shipping, with a minimum of manual entry of information.

One of the best software upgrades uniquely targeted to the small to midsize roll-forming market is Paradigm from Paragon Computing Solutions (www.goparagon.com).

Anthony Martin, manager of product development for Paragon, cites a scenario of the typical customer’s way of doing business when they seek out an integration software solution: “Their salesman is taking the order and likely recording it in some kind of accounting system, maybe even on paper,” he recounts. “That information then needs to be somehow transmitted to the shop. Without a system like Paradigm, usually that means they’re printing paperwork orders, carrying them out to the shop, and someone is keying the information into the controller software.”

Most customers buy into the Paradigm software after outgrowing their old accounting and inventory software.

“We have a few clients that went with the Paradigm system right out of the gate, as they started their business, but more typically, roll formers start with a program like QuickBooks for their accounting, which has very limited management features, and maybe they have another system in place for quota tracking. But when they grow to a pain point, when [those systems] are limiting the growth of their businesses, or costing a lot of extra labor, that’s usually when they get interested in a system like Paradigm.”

The Benefits of Automation

The greatest benefits of automation come down to saving time and minimizing error.

A fully integrated system allows order and inventory information to be input into the system just once, most likely from an office terminal. From there, the information flows to all remaining parts of the process: into the controller software for production, and back out for use in billing, inventory, and shipping. Martin explains how that is accomplished.

“Once an order is finalized, the sales person releases the order and the order goes to production. If the company running Paradigm has equipment that it can interface with (such as Beck Automation’s Connex, AMS Control’s Eclipse, or other), that order would go directly into the machine’s controller.

“Once in the machine,” Martin continues, “the operator should have everything needed to produce the panel or trim.”

There is also an inventory update system built in. “So you would have your coil inventory in Paradigm,” Martin says. “When you produce the panel, whatever amount of inventory was used from that coil, will be updated. That amount is also subtracted from the coil, and the cost is posted associated with that order.”

The Paradigm software does not replace the controller software. In fact, the controller software is required to be in place for full integration; information from Paradigm is transmitted to the controller software.

Currently, Paradigm integrates with Beck Automation and AMS Controls controllers, and SWI Machinery slitters and folders. Now in the development stage is integration with Variobend folders.

Prior to installation, the business does need Windows-based servers and workstations for all employees using it, and network connectivity between the workstations and servers, and connectivity to the controller software.

While the standard system integrates production, modules for accounting, and inventory can be added in Paradigm for a customer portal, and shipping.

Integration of drawing programs

Custom designs are increasingly popular in the roll-forming industry and Paradigm has a Trim Design Program that allows a salesman to create custom designs on the fly, with cost calculations tied to the final drawing. It’s particularly beneficial when creating trim with a unique profile. “The salesperson can draw out the trim right on the screen in front of the customer, and the system records the profile, the amount of metal needed for that profile, and it can calculate a price based on that drawing. And that drawing will follow that order out to the production floor to be produced, and off to shipping as well,” Martin says.

Many of Paragon’s customers are post-frame and low-rise steel-frame customers using third-party building design programs like Construction Maestro, Post-Frame Manager, or SmartBuild. Those can be included into the Paradigm integration.

“So a roll former’s customer might use software like SmartBuild when designing a building, and that, of course, will produce a materials list of all the panels and everything else that goes into the building,” Martin says. “Again, if it’s interfaced with the roll former, potentially someone could do a 3-D drawing of the building, and with a couple of clicks, that materials list can be in the system as an order. With another click it can be in the roll former, and the metal for that building can be produced.”

History in the Roll-Forming Industry

Paradigm Computing Systems, LLC comes with deep roots in the construction roll-forming world. It’s a spinoff of A.B. Martin Roofing Supply, LLC, which originally purchased software from the Paragon company to customize its own accounting system. Eventually, A.B. Martin purchased the company, and set about perfecting the software for roll-forming use.

“There were a few other roll formers looking for systems as well in the market and not finding anything that really met their needs,” Martin says. “So there were some who came onboard early, four or five companies, that were part of the development process. They ran the software in the early days, and in a sense, helped improve it until it reached the point that it was a product that meets the needs of a variety of roll formers.”

Because of its history, learning the software has been made intuitively to speak to roll-forming operators, and optimized for the type of products that a roll former is going to sell.

“Once the system is set up, it’s fairly easy to train users because it is designed for that industry and it uses terminology they’re familiar with,” says Martin. “If they’re coming from another software package, it’s not difficult. If they have no prior software experience, its more of a hurdle.”

The preparation phase is the most challenging for companies. “It’s usually a progression that a client goes through,” Martin says. “It’s a big change right up front, they experience a bit of upheaval, but then they start addressing very small and specific areas that over time can add up to a lot of benefits — order accuracy, production levels, and just having the ability to have a view into their entire process.”

Martin relates a series of conversations he had with a Paradigm customer.

“Not long after starting to use the Paradigm software, he made the comment that if he had to do it again, he wasn’t sure that he would because it was such a big change for them. I spoke to him more recently and he said, we’ve gone from the point of being unsure if we made the right decision, to being very glad that we did.”

Change does not come easy for most businesses, so it often means reaching a tipping point first. Martin says he generally meets a business owner “when they’re very frustrated with their current processes and it’s to the point where they are losing business or customer satisfaction because they’re not being able to meet their customers’ expectations any more. They realize that in order to get beyond that, and to keep growing, they need to systematize.”

It’s a frustration that more and more roll formers are experiencing as the popularity of metal construction continues. “From an automation standpoint, I foresee the demand for connected systems — systems that communicate and share data — is going to continue,” Martin believes. “Overall there’s an expectation that it used to be a luxury or something nice to have, but now it’s becoming more of an assumption that this system will be included.”

#3

Online Procurement: Metal Goes

Amazon-Style

It’s a situation you have likely found yourself in: You have a customer looking for a quick turnaround but you don’t have the materials and can’t get them in time. Or, you ordered too much of the wrong thing and now you have excess materials sitting unused; you want to get rid of it to free up space and capital.

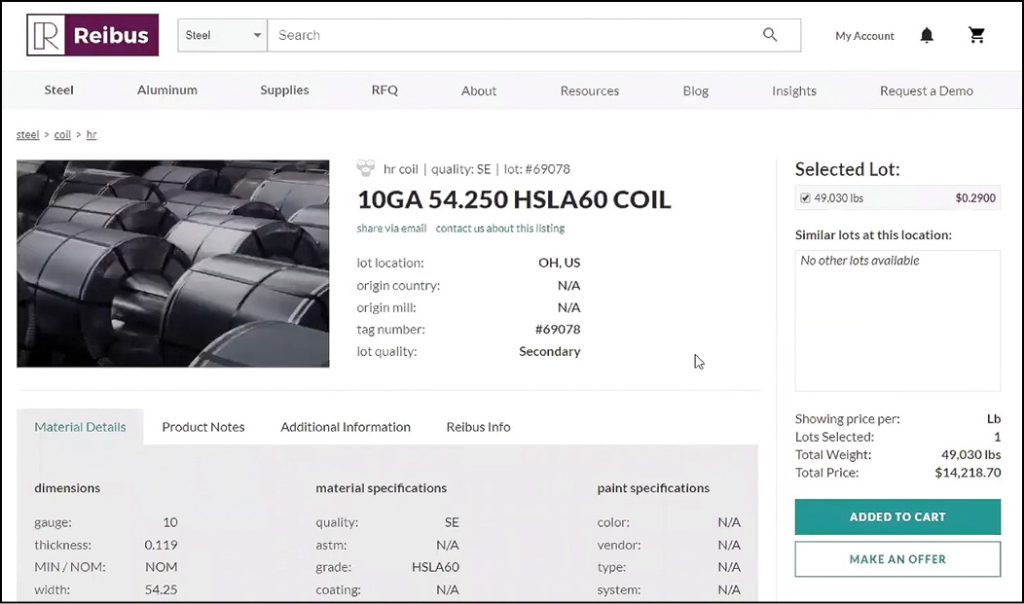

John Armstrong understood the frustrations of buyers and sellers in the metal construction industry firsthand and sought to do something about it. He developed the first Amazon-style platform to buy and sell metal coil and other industrial materials online. Called Reibus International (www.reibus.com), it’s a new kid on the internet block, opening for business in May 2018 but already finding success in filling a void in the procurement industry.

Jon Haley joined the company soon after its launch to run sales, and he explains that the supply chain channel in the metals industry has long been stuck in a rut between long lead times at the mill versus more rapidly changing customer demand. Trying to predict demand has always been a moving target, resulting in materials getting stuck in storage, begging for buyers.

“The metals industry in particular is very archaic in methodology and how it sources material,” he says. “It just hasn’t evolved like many industries have. I’ve been in it most of my life, so I’m also to blame. There’s not been a lot of innovation.”

Both Haley and Armstrong worked for the same division of a company now called Omnimax and saw the imbalances on a daily basis. “For the division, I ran sales and John ran supply chain management. His office was next to mine and I would hear him getting frustrated with the industry,” Haley says. “We had 20 plants to keep operational but getting forecasting from our customers and from my sales team was very challenging. John was buying millions of tons of steel and aluminum per year — he was one of the largest buyers in the country in our space — and even he couldn’t significantly correct the inherent inefficiencies.”

Haley says the seeds were thus planted for Armstrong to seek a better way for the metals industry to manage procurement.

The idea germinated for about 10 years. The perfect time to launch an online alternative coincided with technology improvements and the increasing acceptance of consumers to buy online. “I don’t think it would have taken off like it has six or eight years ago. I don’t think the technology was there yet, and I don’t think people were as comfortable then as they are now buying things online,” Haley says, adding: “And now that we have this younger generation of millennials coming into positions of authority, they want to do business a lot differently than an older manager like myself. These younger buyers would rather not go to lunch with the sales representative; they want to quickly have all the data in front of them and transact online. Reibus gives them the ability to do that.”

Online Buying With An Industrial Twist

While often comparing themselves to an eBay or an Amazon of the industrial metals industry, there are some important differences. Unlike Amazon, Reibus does not maintain warehouses. “We have very little overhead. Our overhead is technology and people,” Haley says.

Another difference: Reibus has a sales team that actively sells listings for its clients, unlike a passive site such as eBay where there is no one actually pushing your product for you.

The Reibus team enables the platform as a simple tool where materials are listed to be bought, sold, and shipped quickly and anonymously.

“Everything in our system is anonymous and very secure,” Haley says. “We use Amazon Web Services in the background. It’s the most secure, proven software there is. There are hundreds of players in the whole distribution space, very large service centers, some small service centers, and in the past, if they got into a bind for inventory, or were having a hard time finding an item, the last thing they would do is pick up a phone and call one of their competitors. We now give them access to all players in the segment: They’re happy they got rid of the excess inventory and the buyer is happy because they get what they needed when they needed it.”

Using Technology Familiar to Users

Leveraging the technology that already exists in the consumer channel makes the actual process simple. A dashboard of information is offered to a potential buyer, including price and specification data needed to make an immediate buying decision. Buyers are able to make an offer on any item they have interest in and the seller has the ability to accept or counter that offer. While buyers and sellers remain anonymous, mill certification stays with the metal, assuring that the mill warranty is passed on to the buyer.

Reibus takes care of the shipping logistics and calculates the freight rate instantly at checkout based on your shipping address. Blind bills of lading assure that you can buy from a competitor without repercussion. No one is the wiser —not the buyer, not the seller.

Three levels of material are sold: Prime materials are new, fresh materials coming right out of the production facility; Excess Prime, is also prime material with a warranty, but may have been sitting somewhere for a few months or more; Secondary Material might be damaged material, like white rust or edge damage. All are clearly denoted so the buyer knows the category prior to a sale.

“We really view it as a platform that everyone in the industry can use, whether you’re a service center, a roll former, a distributor, a mill, or another OEM fabricator,” Haley says. “Our platform is a professional procurement manager. The technology allows you to see thousands of product listings instantly versus the old method of making 15 phone calls to find the best price.”

Just Reibus It

The company is hoping to coin a slogan, or marketing tagline like “Just Reibus It.”

“We want people’s first inclination in the morning, when they’re looking at their inventories, to get on Reibus to see what they have available,” says Haley.

All buyers are welcome, big or small, whether you buy one coil or a truckload.

Haley is quick to point out that they are not a replacement for the traditional coil or metal supplier, and aren’t their competition, rather, another tool in the toolbox. “We simply want to facilitate buyers and sellers within the industrial space. That’s our mission,” he says.

“Producers, distributors and traders, and manufacturers, all of them have different needs and how the Reibus website can help them,” Haley continues. “I had someone tell me that we’re an extension of their sales team; he’s given access to brand new customers for free. So we’re acting almost like an agent for him.

“I’ve had distributors or service centers say we help them improve their turnover, help them reduce their inventory.

“But one of the things we’re finding, and this is really a nice surprise, when we set up the company, we expected to have two different groups: sellers on one side, and buyers on the other. What we’re finding, especially the service centers, they’re both buying and selling. So on one end of the spectrum we’re helping them reduce their inventory, improve their turnover rates, and in some cases improve their buying power at the mill because their velocity rates are increasing.”

In many cases the 4-month lead-time for coil has evaporated. “Anything on our website is ready to ship, it’s sitting somewhere in a facility,” he notes.

The company is rapidly finding its niche. In less than two years, 12 employees have joined Armstrong, and Haley expects 20 employees by Q1, 2020, mostly in sales. There’s now buy-in from investors in New York and Silicon Valley to help finance new goals and growth.

“The market potential is tremendous. … We estimate, that just in North America alone, the fabricated metals industry is $280 billion. If we just get a sliver of those transactions we’re a very large company very quickly. And that’s all we want to be. I don’t want to replace what the mills do; I can’t. I don’t want to replace what the service centers do; I can’t. I just want to smooth out the peaks and valleys of the supply chain.” RF

Editor’s Note: Both Josh Beck and Jon Haley will be making presentations at the Construction Rollforming Show. Show information starts on page 29 in this issue.

- The jobs screen allows you to view, edit, schedule, send, import, and recall jobs. A job is a group of any number of items with a common profile and material.

- Software like Paradigm, shown here, offers ultimate integration of all systems from order entry through shipping.

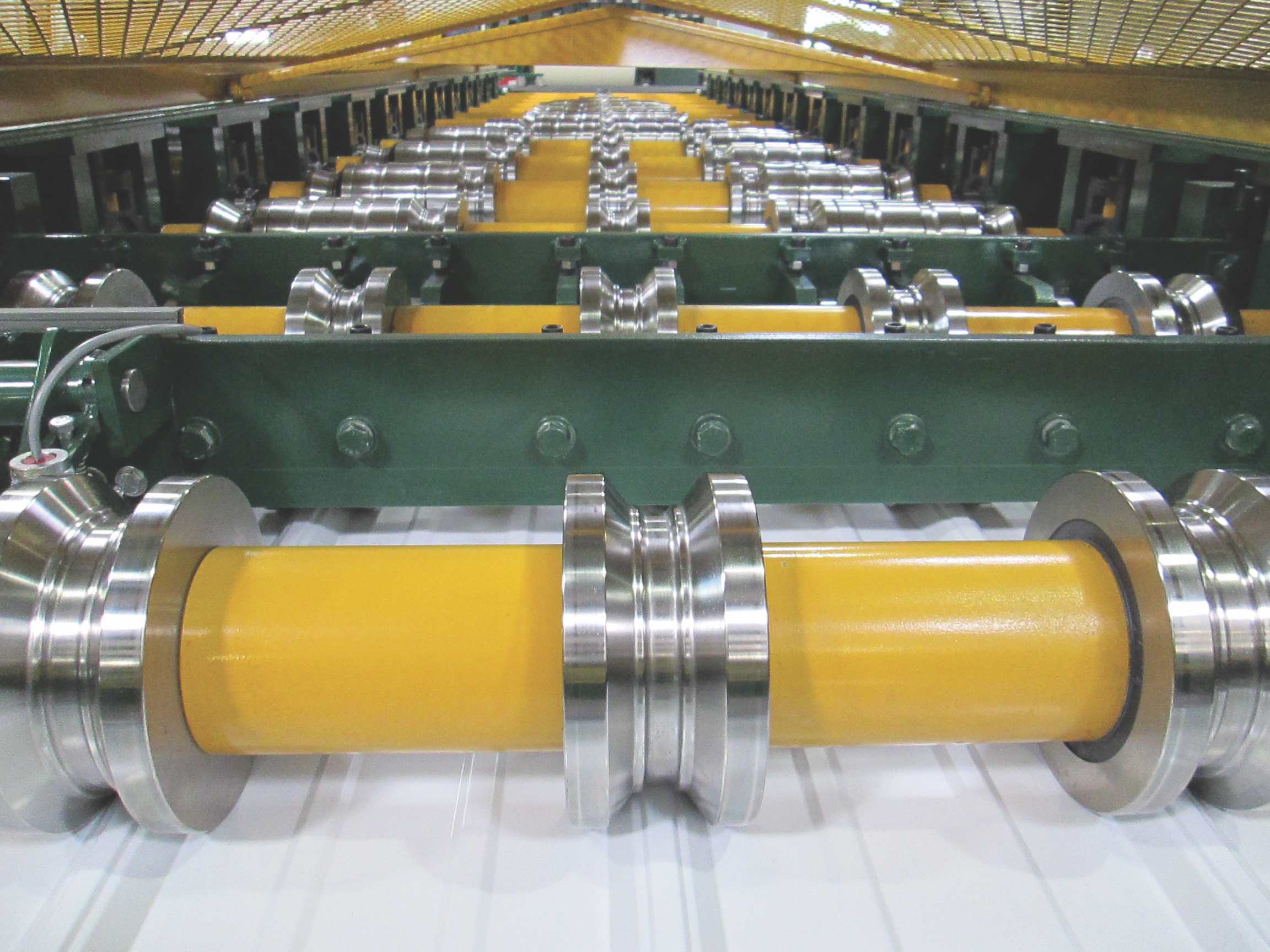

- Photo taken from a production line at Union Corrugating, Tipp City, Ohio plant, by Sharon Thatcher

- Standard view of a product page showing price, specs, and general location of the material offered. Recently added was a “Make an Offer” feature.